Complete Guide to SMS Loans: Are SMS Loans Right for You?

Outline:

– Definition and role of SMS loans in personal finance

– Suitability: borrower profiles, benefits, and trade-offs

– Step-by-step application and verification

– Amounts, costs, and regional differences

– Safety, security, and a practical decision checklist (conclusion)

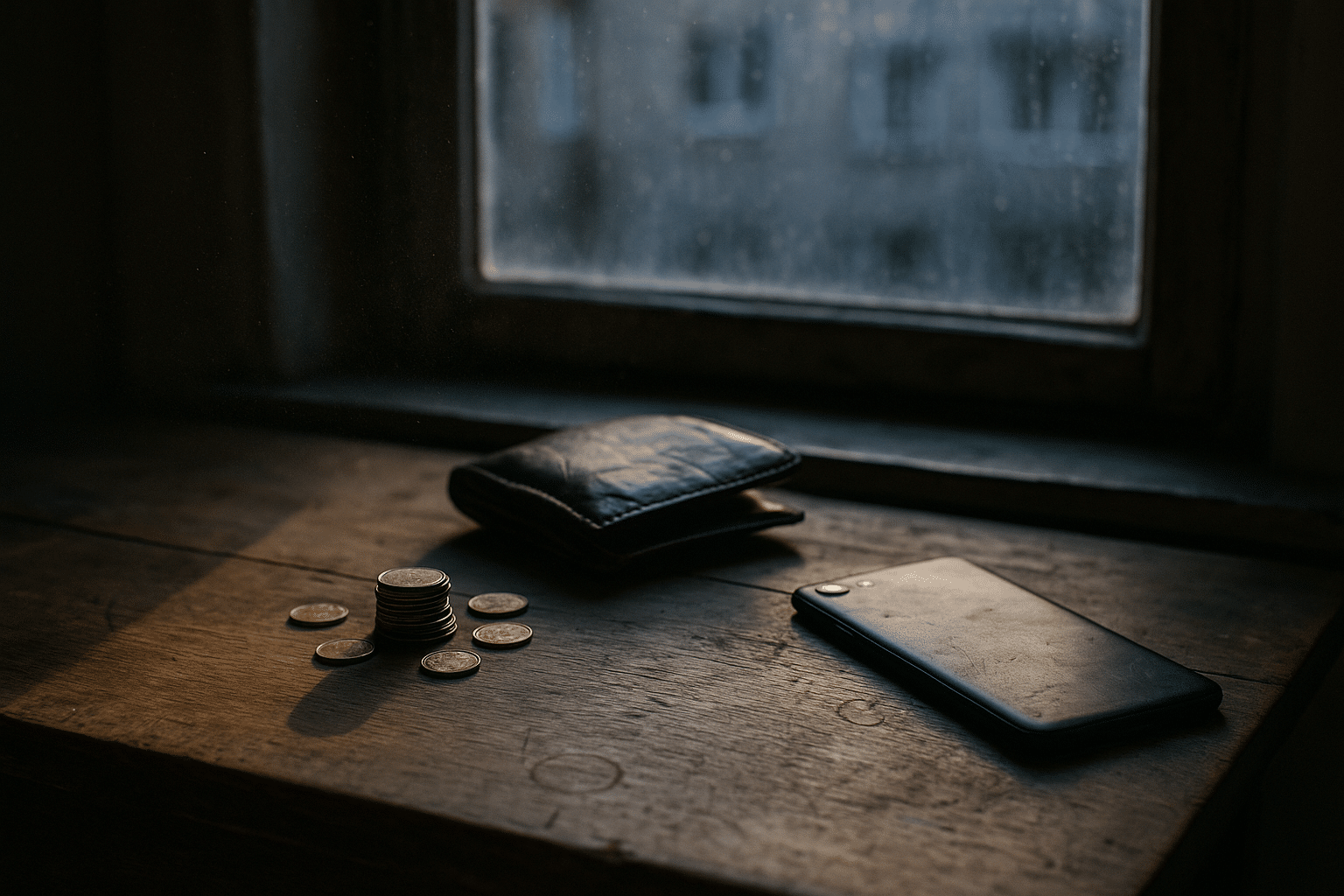

What Are SMS Loans and When Speed Matters

SMS loans are a short-term financing option sometimes used for emergencies; review and funding times can be relatively quick depending on the provider. At their core, these loans are small, fast-turnaround advances that can be requested and confirmed via mobile channels, often with streamlined verification. They tend to prioritize speed and convenience, which is why they’re frequently considered for urgent, one-off expenses—think a vehicle repair that gets you back to work the next morning or a medical copay due today.

Because speed is a central feature, lenders compress underwriting into a brief risk assessment that can include identity checks, income verification, and affordability estimates. Approval times can range from minutes to a few hours during business days, with funds arriving the same day or next day depending on cutoffs and banking rails. That convenience has trade-offs: fees and interest on short-term microcredit are typically higher than traditional personal loans or credit lines, and terms may be measured in days or a few weeks rather than months.

It helps to compare an SMS loan to other “last-mile” options. Overdrafts might be automatic but carry their own per-incident fees. Credit cards can be flexible, yet interest can accumulate if you revolve the balance. Payment plans with service providers might be available at low or no cost if you ask. An SMS loan sits alongside these tools: small, quick, and potentially costly if extended or rolled over.

When might an SMS loan make sense? Consider these scenarios:

– A small, time-sensitive bill where delaying creates a larger penalty or risks lost income.

– A repair that restores essential transportation or childcare.

– A short cash-flow gap where you’re confident repayment will occur on the next paycheck.

When should you be cautious or avoid them?

– If cheaper credit or a payment extension is available.

– If you’re unsure you can repay on time, risking additional fees.

– If multiple debts are already straining your budget, making a cycle more likely.

Taken thoughtfully, these loans can function like an umbrella in a sudden downpour—useful for a brief squall, less so for a season of rain. The key is pairing speed with a plan: know the total cost upfront, schedule repayment, and consider whether a lower-cost alternative could cover the same need.

Who Should Consider Applying

Who is suitable for applying for SMS loans. Suitability depends on a borrower’s financial stability, access to alternatives, and the urgency of the expense. A practical rule: match the duration of the debt to the life of the need. If you’re covering a one-time, small emergency you can repay within weeks, a short-term product can align with that timeline. If your need is ongoing—like covering routine monthly expenses—a revolving or longer-term option may be more sustainable.

Indicators that an SMS loan could fit:

– You have a predictable paycheck and a clear repayment date within days or weeks.

– The loan amount is small relative to your income, keeping debt-to-income manageable.

– The cost of delay is higher than the loan’s total cost (for example, losing a shift worth more than the fee).

Signals to pause or consider alternatives:

– You’ve used short-term loans repeatedly over the last few months, which could indicate a structural budget gap.

– Your budget leaves little margin after essentials, making late fees or rollover risk more likely.

– A lower-cost option exists, such as a credit union small-dollar loan, a payment plan with a provider, or employer-based advances.

Lenders often evaluate suitability through affordability checks, bank account analysis (e.g., income deposits and typical expenses), and past repayment behavior. While minimal, these checks aim to reduce default risk for both parties. As a borrower, performing your own “pre-check” is just as important: list your next two pay periods, estimate essential expenses, and confirm the repayment date and amount. If the payment crowds out necessities or forces another loan, that’s a red flag.

A brief example helps. Imagine a worker facing a $180 tire replacement today to keep a delivery job tomorrow. Their next paycheck in 10 days covers the full amount plus fee without compromising rent or food. That use case is aligned with the product’s short horizon. Conversely, if the same borrower anticipates ongoing shortfalls, a budgeting adjustment or a different type of credit may be wiser. In short, suitability is less about credit scores alone and more about timing, cash flow predictability, and the existence of cheaper, safer alternatives.

How to Apply: From SMS to Disbursement

Common online SMS loan application process. Although specific steps vary by jurisdiction and lender, most experiences follow a similar pattern designed to balance speed and compliance. Before starting, prepare your government ID, bank or mobile wallet details, employment information, and a rough budget to confirm you can repay on schedule.

Typical steps:

– Pre-qualification: You enter basic information (age, residence, income) to check broad eligibility.

– Account creation: Confirm your phone number via one-time passcode and set a secure password or PIN.

– Identity verification: Upload or scan an ID and, in some regions, complete a live selfie or liveness check to meet KYC requirements.

– Income and affordability: Connect a bank account or provide recent pay statements; some systems analyze transaction data to estimate income stability.

– Offer review: You receive a provisional amount, term, fees, and APR. Review the total cost of credit, late fees, and any rollover restrictions.

– Consent and signature: Accept disclosures electronically; regulations often require clear, prominent cost summaries before signing.

– Funding: Depending on banking rails, funds may arrive within minutes, the same day, or the next business day. Cutoff times and weekends matter.

– Repayment setup: Choose a due date and authorize debit from your account or wallet; some lenders allow early payoff without extra fees.

Speed does not eliminate diligence. Read disclosures, confirm whether the lender reports to credit bureaus, and note the consequences of late payment. If an offer seems unusually large for your income or glosses over fees, treat that as a caution signal. Legitimate providers communicate clearly, give you time to review, and provide customer support channels for questions.

Security-wise, never share your one-time passcodes, and avoid applying on public Wi‑Fi. Check that the website uses up-to-date encryption (look for secure connection indicators) and that the company lists a physical address and regulatory registration number where applicable. Finally, keep copies of your agreement and repayment schedule. A few minutes of setup can save hours of stress later.

Amounts, Costs, and How Regions Differ

SMS loan application amounts and interest rate ranges in different regions. While numbers shift with regulation and market conditions, we can outline common patterns to help you benchmark an offer. Loan sizes are typically small—often equivalent to about $50–$1,000 or the local-currency equivalent—with due dates in 7–45 days. Costs are quoted as fixed fees, daily caps, monthly rates, or annual percentage rates (APR), depending on local rules.

Snapshots by region (indicative, not exhaustive):

– United States: Short-term microloans often range from about $100–$1,000. In states with permissive rules, effective APRs can reach several hundred percent. Many states restrict or prohibit high-cost short-term lending, while others cap rates near 36% for small loans. Always check your state’s current consumer credit regulations.

– United Kingdom: High-cost short-term credit is constrained by daily price caps, commonly around 0.8% per day, with a total cost cap that prevents borrowers from repaying more than double the principal and limits default fees. Typical amounts align with a few hundred pounds.

– European Union (varies by country): Several countries impose rate caps or fee restrictions. Indicatively, microloans often range from €50–€1,000. Some markets cap nominal interest (for example, around a few dozen percent annually) and limit setup or late fees; others set broader “usury” thresholds tied to average market rates.

– Nordics: Historically active microcredit markets have seen tighter rules in recent years, with interest and total-cost caps alongside stricter affordability checks. Ticket sizes frequently mirror €100–€1,000 equivalents.

– Sub‑Saharan Africa: Mobile-money–linked microloans frequently start small (e.g., $10–$200 equivalents), with costs expressed as monthly fees or interest plus platform or processing charges. APRs vary widely based on country and product type.

– Southeast Asia: App- and SMS-based microloans often range from $20–$500 equivalents, commonly priced via monthly rates (for example, low single digits to mid-teens) plus service fees; regulation is tightening in several jurisdictions.

Two points are essential. First, “APR” can look high for short terms even when the absolute dollar cost is modest; however, APR still helps you compare apples to apples. Second, fees compound quickly if you roll over or renew the loan. For example, a $300, two-week loan with a $15-per-$100 fee costs $45; renewing once doubles that fee to $90 before any late charges. Always compute the total cost through the exact due date, and verify whether early repayment reduces fees.

Because rules evolve, rely on official consumer-protection sites in your country for the latest caps and rights, and make sure any lender you consider publishes standardized cost disclosures in line with local law.

Safety, Security, and a Practical Decision Checklist

SMS loan safety and security guide. Risk management starts before you apply and continues until the final payment clears. Given the prevalence of phishing and identity theft, treating your phone number as a key to your finances is wise. A legitimate lender should be licensed or registered where required, disclose costs in plain language, and offer reachable customer support.

Security tips:

– Verify licensing using your local regulator’s registry; avoid unsolicited links in texts.

– Apply only on secure connections; keep your device’s OS updated and use a screen lock.

– Never share one-time passcodes or full ID numbers over SMS; legitimate staff won’t ask.

– Read the privacy policy to understand data sharing; opt out of marketing where possible.

– Watch for red flags: upfront “processing” payments before approval, pressure to act instantly, or unclear fee tables.

Financial safety goes hand in hand with digital safety. Build a quick repayment plan before you borrow: list your next pay date, essential bills, and the loan payment. If the math leaves you short for rent, utilities, or food, seek alternatives such as payment extensions with service providers or small-dollar programs from community lenders. Compare at least two options on total cost and due date, not just the headline fee.

A practical decision checklist:

– Need: Is the expense urgent and time-bound, or ongoing?

– Amount: Can you borrow the smallest amount that solves the problem?

– Cost: Do you know the total you’ll repay, including late or collection fees?

– Timing: Is the due date aligned with certain income, not just hopeful estimates?

– Exit: Can you repay without borrowing again the following week?

It also helps to monitor your accounts after funding. Confirm the deposit, track the automatic debit date, and maintain a small buffer if possible. Should anything change—job hours, unexpected bills—contact the lender early to discuss hardship options permitted by local law. Many providers can reschedule within regulated limits, and proactive communication may prevent extra charges.

Conclusion for readers: Short-term credit can be a useful bridge when used sparingly and with clear intent. Treat the decision like crossing a narrow footbridge in windy weather—hold the rails, take measured steps, and keep your destination in sight. By verifying legitimacy, safeguarding your data, and matching the loan to a brief, repayable need, you give yourself the greatest chance to resolve the emergency without carrying the cost into next month.